Let me speak to you using a language that I dearly love: Mathematics.  Promise! This will just be an easy one. This blog post will just involve basic numerical computations which we know by heart.

Promise! This will just be an easy one. This blog post will just involve basic numerical computations which we know by heart.

*winks*

For the past week, I have learned about different investment vehicles and one of them is mutual fund investment. I also stumbled on what Albert Einstein referred to as the greatest magic in the world. Janjaraaaan…. *drum roll please* It is called compound interest.

Sounds familiar? We have studied about compound interest during our elementary/high school days and if you guys have credit cards, you must know (and this is a FACT) that credit card companies use compound interest in computing for our monthly outstanding balance. Ouch! This will be discussed in another topic.

Make Your Php500 into Php500,000

Back to mutual fund investments, I have learned that while we are at the early season of our working lives, we have to discipline ourselves not just to save, but to invest, a portion of our hard-earned income that can provide us with passive income1 which we can enjoy later on.

Then, how can we make our monthly savings of Php500 into half a million? [WoW!!!] And how long will we be able to achieve this? Warning: Grab your calculator! Computations will soon follow.

The Straight-Line Method Disclaimer: “Straight-line” is my own term for this kind of computation and was not obtained in any other source. Other sources may use a different “code name”. ;)

Using the straight-line method:

If we have monthly savings of Php500 for 12 months = Php6,000 per year

Our target amount is Php500,000.

Hence, Php500,000 divide by Php6,000 = 83.33 years!!! <---- This will be the time when we get to achieve our half a million with Php500 monthly savings. Whooaaaaa! If we are lucky enough to live for more than 100 years old, then we will be able to enjoy this. Yay!

The Compound Interest Method

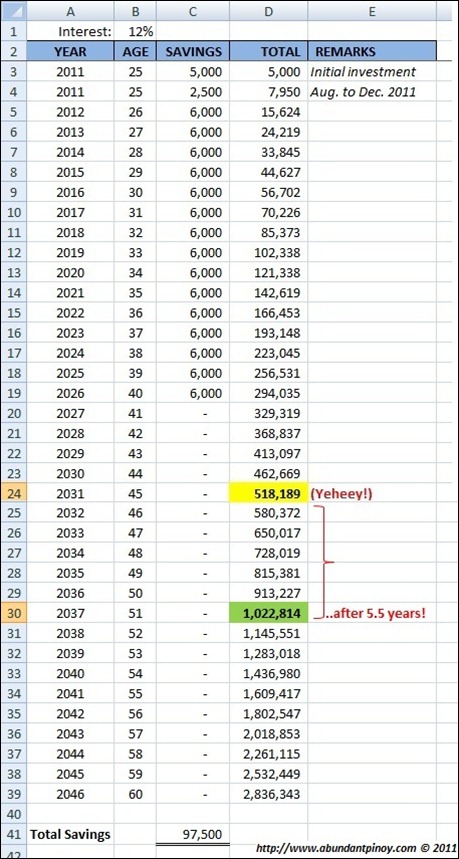

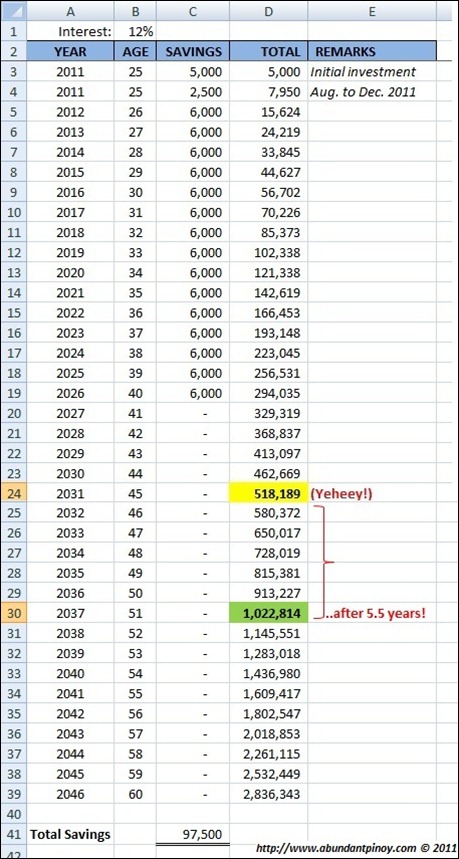

Let me introduce to you this method using the following illustration:

Based on our illustration above, with our Php500 monthly savings for the next 15 years, we can achieve our half a million financial goal within 20 years (way better compare to 83.33 years! Right?) and we achieved this with just a total of Php97,500 total savings!!! Plus in the year 2031, the total value of our earnings is 421% greater than our total savings! Whooopieee! \(",)/

Want more? In approximately just 6 years after that we achieved our target of Php500,000, we are able to achieve our first million! Amazing, isn’t it?! This is the magic power of compound interest. =)

The Php500 Monthly Savings

Given that we work for 20 days in a month, this would just be equivalent to Php25 per day.!!! I believe that we can achieve to save Php500 amount monthly, and even MORE than that. Right?! Right?!

Dbah? Dbah?

Dbah? Dbah?

- - - - - - - - - - - - - - - - - - - - - - - -

Footnotes:

1Passive income is an income received on a regular basis, with little effort required to maintain it. [Wikipedia]

2If you want to check on the top performing mutual fund companies in the Philippines, please refer to this site: http://pifa.com.ph/factsfignavps.asp

Did the numbers speak for themselves? If you would like to have a copy of the formula we used, feel free to leave a comment and let us know. We would be glad to provide you with the soft copy of this computation.

If you would like to have a copy of the formula we used, feel free to leave a comment and let us know. We would be glad to provide you with the soft copy of this computation.

Happy investing everyone! Enjoy your weekend.

Cheers! \(“,)/

Lyn-Lyn

30 July 2011

QUOTE: “Start to save as much as you can as soon as you can.” – PSE

*winks*

For the past week, I have learned about different investment vehicles and one of them is mutual fund investment. I also stumbled on what Albert Einstein referred to as the greatest magic in the world. Janjaraaaan…. *drum roll please* It is called compound interest.

Sounds familiar? We have studied about compound interest during our elementary/high school days and if you guys have credit cards, you must know (and this is a FACT) that credit card companies use compound interest in computing for our monthly outstanding balance. Ouch! This will be discussed in another topic.

Make Your Php500 into Php500,000

Back to mutual fund investments, I have learned that while we are at the early season of our working lives, we have to discipline ourselves not just to save, but to invest, a portion of our hard-earned income that can provide us with passive income1 which we can enjoy later on.

Then, how can we make our monthly savings of Php500 into half a million? [WoW!!!] And how long will we be able to achieve this? Warning: Grab your calculator! Computations will soon follow.

The Straight-Line Method Disclaimer: “Straight-line” is my own term for this kind of computation and was not obtained in any other source. Other sources may use a different “code name”. ;)

Using the straight-line method:

If we have monthly savings of Php500 for 12 months = Php6,000 per year

Our target amount is Php500,000.

Hence, Php500,000 divide by Php6,000 = 83.33 years!!! <---- This will be the time when we get to achieve our half a million with Php500 monthly savings. Whooaaaaa! If we are lucky enough to live for more than 100 years old, then we will be able to enjoy this. Yay!

The Compound Interest Method

Let me introduce to you this method using the following illustration:

- Most mutual fund investments require Php5,000 as an initial investment.

- If we start our investment on August 2011, our Php500 monthly savings will total to Php2,500 from August to December 2011. (Php500 multiply by 5 months)

- The performance of mutual fund investments in our country averaged 12 percent2 a year. Let’s assume this percentage for our illustration.

Based on our illustration above, with our Php500 monthly savings for the next 15 years, we can achieve our half a million financial goal within 20 years (way better compare to 83.33 years! Right?) and we achieved this with just a total of Php97,500 total savings!!! Plus in the year 2031, the total value of our earnings is 421% greater than our total savings! Whooopieee! \(",)/

Want more? In approximately just 6 years after that we achieved our target of Php500,000, we are able to achieve our first million! Amazing, isn’t it?! This is the magic power of compound interest. =)

The Php500 Monthly Savings

Given that we work for 20 days in a month, this would just be equivalent to Php25 per day.!!! I believe that we can achieve to save Php500 amount monthly, and even MORE than that. Right?! Right?!

- - - - - - - - - - - - - - - - - - - - - - - -

Footnotes:

1Passive income is an income received on a regular basis, with little effort required to maintain it. [Wikipedia]

2If you want to check on the top performing mutual fund companies in the Philippines, please refer to this site: http://pifa.com.ph/factsfignavps.asp

- - - - - - - - - - - - - - - - - - - - - - - -

Did the numbers speak for themselves?

Happy investing everyone! Enjoy your weekend.

Cheers! \(“,)/

Lyn-Lyn

30 July 2011

QUOTE: “Start to save as much as you can as soon as you can.” – PSE

13 comments:

Hi,

I would like to have the formula for PHp 500 to Php 500,000. Kindly send it to my email add.

Could you blog about US debt ceiling crisis and its effect in the world market?

Nice job.

Cheers,

Erb

Hi Erb,

Thank you for your response on our post. Whoooaw! A blogpost on US debt ceiling crisis and its effect in the world market? Hmmm… why not? I will consider writing something about that. Let me share, for the meantime, my itsy-bitsy-teeny-weeny thoughts about it. A lot of trading means, such as bonds, stocks, forex, and commodities, will surely be affected by the US debt ceiling crisis, given that US dollar is the reserve currency of the world. Let’s see how things will go once the US debt ceiling debate will come to conclusion anytime next week. ^_^

As promised, please check your e-mail for the excel file of the compound interest computation.

Enjoy investing! =)

Cheers,

Lyn-Lyn \(“,)/

sis lyn, can you give me also the formula. =D thanks.

Hi sis ofie! =D Wow…natuwa ako to read your comment here. ^__^ Please check your e-mail, we just sent you the excel file of the compound interest computation. Happy investing, sis! Kitakits sa kfam. \(“,)/

hi to my beautiful and ever dearest sister, roce. first of all, im so glad you have taken this step to let others become aware of investing a little of their hard earned money in investment vehicles like stocks, mutual funds, bonds, etc. this had been my dream 5 years ago: for Filipinos to become financially abundant and proclaim to the whole world that we are a wealthy nation: in spirit, in natural resources, in our financial knowledge that would lead us to become financially-stress free.

to ERB:in my humble opinion, US debt ceiling crisis had been approved by the US congress and senate and was signed by President Obama last week. but why is the US stock market still down? Primarily, I believe it was the recent downgrade of US debt rating from triple A to AA+ by S&P (which is a rating agency.) Now, i think your next question would be, what would be its effect on Phisix? I believe in our Philippine market and its resiliency with the world market. The recent drop in our local index is just the short term effect of the downgrade of US debt. Moody and FItch as well as S&P upgraded our debt rating to BB+, a good indication that our economy is now on the radar of the worldwide fund managers. Month of August is the best time to plant but be very careful and be highly selective with your stock picks.

to all readers: i highly recommend that you keep reading about financial literacy and investments because is will certainly liberate you and increasing one’s financial knowledge only shows that you want to become a good steward of the blessings that we continually receive from our Almighty GOD. most of all, ACT. have a great week to everybody!

thanks for this blog ha, i forwarded the link to my kids, i challenged them to do it and i'll match their saving 100%, di pa sila puede mag open ng MF account, so sa akin muna maki ride on.

Thanks again for a blog simply made for Juan de la cruz like me.

JMG

It is truly a great and helpful piece of info. I’m glad that you shared this useful information with us. Please stay us informed like this. Thanks for sharing.

Please send me the copy of the formula. johnmichael.garde@yahoo.com

Hi bro JMG, already sent the formula to your e-mail. :) Happy investing! \(",)/

Hi ms lyn, can you also send me a copy of the formula, kingmarc_d_great@yahoo.com thanks a lot. :)

Hi Miss Lyn, please send me a copy of the formula. Thank you and God Bless. paul.rpbm@gmail.com

hi, very informative, can you send me the soft copy, I have 4 daughters at an early age I encouraged them to save, that's why they have their own passbook, all the money that they get from their ninangs they deposited it to their accounts, soon they will invest to mutual funds. here's my email address, myrna021870@gmail.com, God bless!!

Hi, I would like to point out certain miscalculations...

First of all, The Straight-Line Method that you mentioned. I believe you are providing a one-sided or incomplete computation. You failed to include interest earning (if deposited into a bank through regular savings or time deposit). This would greatly reduce your projected 80+ years. Which will be a better comparison against your "compounded interest computation".

Second, the computation you provided for the mutual funds is incorrect since you failed to take into account that the additional investment of "6000" should only be additional investment for that year. But in your calculation you included it as a basis for your principal amount for the 12% increase in value. The correct amount for your 2012 is supposed to be 14904 only(2011: 7950*1.12= 8904 + 6000 savings).

Hope this helps

Post a Comment